An Insurance Strategy in 2024

Companies confront a slew of risks in 2024’s dynamic and ever-changing business scene, many of which may have a substantial impact on their operations, finances, and image. Natural catastrophes and cyber attacks are only a few of the numerous possible dangers.

To negotiate this hard terrain, every business, regardless of size or sector, must establish and implement a solid insurance plan. This essay investigates why having an insurance strategy is critical in 2024, diving into particular risks, coverage alternatives, and long-term advantages for organizations.

What is An Insurance Strategy?

An Insurance Strategy is a methodical, well-thought-out plan that organizations or people employ to control and reduce risks by utilizing insurance products. In order to guard against financial losses that can result from unanticipated occurrences or liabilities, it entails a methodical assessment of prospective risks and the creation of a customized insurance plan.

An insurance strategy’s main objective is to offer a thorough and proactive framework for risk management. This entails determining possible risks, assessing their possible consequences, and choosing suitable insurance policies to transfer or lessen those risks. To cover various areas of risk exposure, the approach could combine several kinds of insurance policies.

Understanding the Evolving Business Risks

As the business landscape transforms, so do the risks that companies face. Before delving into the importance of an insurance strategy, it’s crucial to identify and comprehend the evolving risks that businesses encounter in 2024.

Cybersecurity Threats

With the increasing reliance on digital technologies, companies are more vulnerable than ever to cybersecurity threats. Data breaches, ransomware attacks, and other malicious activities can lead to substantial financial losses and reputational damage.

Supply Chain Disruptions

Global supply chains are interconnected, making companies susceptible to disruptions caused by natural disasters, geopolitical events, or unexpected shocks like the recent pandemic. Supply chain disruptions can lead to production delays, increased costs, and customer dissatisfaction.

Climate Change and Environmental Risks

The impact of climate change is becoming more pronounced, with extreme weather events posing a threat to businesses. Floods, hurricanes, and wildfires can damage property, disrupt operations, and lead to substantial losses.

Employee-related Risks

Issues related to employees, such as workplace accidents, injuries, or employment practices liability claims, can have significant financial and legal consequences for companies.

Regulatory Changes and Legal Challenges

The regulatory landscape is constantly evolving, and companies must stay compliant to avoid legal challenges. Changes in laws or industry regulations can result in unforeseen liabilities and legal expenses.

Why an Insurance Strategy?

In light of the diverse and evolving risks, having a well-defined insurance strategy is paramount for companies in 2024. The benefits extend beyond mere financial protection, encompassing strategic risk management, operational stability, and long-term sustainability.

Financial Protection Against Uncertainties

The primary purpose of insurance is to provide a financial safety net when the unexpected occurs. Whether it’s property damage, a cyberattack, or a liability claim, insurance coverage helps companies mitigate the financial impact of unforeseen events, allowing them to recover and continue operations.

Safeguarding Business Assets and Property

Property insurance is a fundamental component of an insurance strategy, protecting physical assets such as buildings, equipment, and inventory. In the face of natural disasters, accidents, or vandalism, having property insurance ensures that the company can rebuild and replace essential assets.

Mitigating Liability Risks

Liability insurance is crucial for protecting companies from legal liabilities and potential lawsuits. General liability insurance covers bodily injury and property damage claims, while professional liability insurance addresses risks related to professional services. A robust insurance strategy ensures that companies can navigate legal challenges without compromising their financial stability.

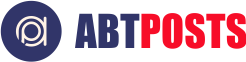

Addressing Cybersecurity Concerns

In an era where digital threats are pervasive, cyber insurance has become a necessity. This specialized coverage protects companies from the financial fallout of data breaches, cyberattacks, and other digital risks. An insurance strategy that includes cyber insurance is essential for maintaining trust with customers and stakeholders in an increasingly interconnected world.

Ensuring Business Continuity

Business interruption insurance is a vital component of an insurance strategy, providing coverage for lost income and operating expenses during periods of business disruption. Whether the interruption is due to a natural disaster, supply chain issues, or other unforeseen events, this coverage helps companies weather the storm and resume operations more swiftly.

Protecting Against Employee-related Risks

Workers’ compensation insurance is essential for covering medical expenses and lost wages in the event of workplace injuries. Additionally, employment practices liability insurance protects companies from legal claims related to employment practices, such as wrongful termination or discrimination. By addressing employee-related risks, companies can foster a safer work environment and mitigate potential legal challenges.

Adapting to Regulatory Changes

Regulatory changes are inevitable, and companies must be prepared to adapt. Insurance strategies should include regular reviews to ensure that coverage aligns with evolving regulatory requirements. This proactive approach helps companies stay compliant and avoid legal and financial repercussions.

The Crucial Role of Liability Insurance for Health Professionals

Conclusion

Choosing the right deductible and coverage limits is a crucial part of developing a successful insurance plan. Businesses should carry out a comprehensive risk assessment, taking into account things like asset value, prospective liabilities, and general financial health. Higher coverage limitations result in higher rates even when they provide more protection. Finding the ideal mix guarantees businesses sufficient coverage without adding needless expenses.

Equally crucial is determining the right deductible, or the sum the business must pay before insurance coverage begins. Lower premiums are typically associated with higher deductibles; nonetheless, it is important to confirm that the insurance provider can afford these expenses in the case of a claim.